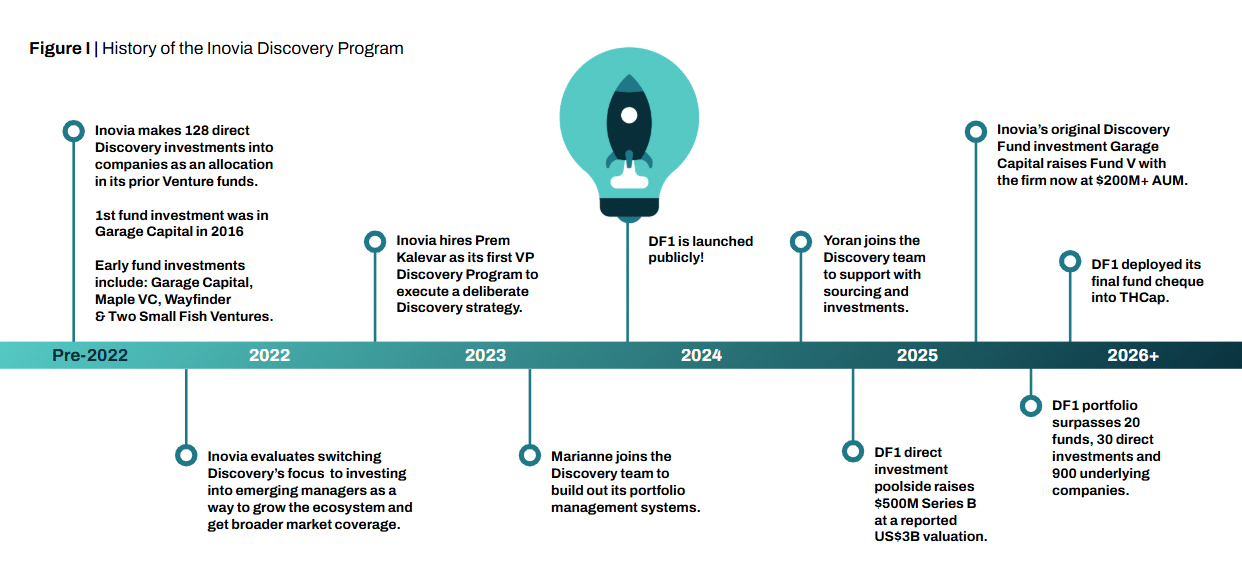

In 2016, as Inovia grew, we expanded our early-stage investment strategy. In addition to investing small cheques directly in early-stage founders out of our venture funds, we began backing emerging managers, who, in turn, were supporting founders at the earliest stages of inception. Fast forward nine years, and this strategy has proved enormously successful, driving greater impact at the early stages of the tech ecosystem.

Today, Inovia Discovery Program supports a total of 31 funds from 23 emerging managers across North America and Europe. Collectively, these managers have invested in roughly 1,100+ underlying companies across several countries and verticals. This growing portfolio has already generated 37 unicorns and 52 successful exits, a testament to the reach and scale of the program.

Discovery now stands as one of the three key pillars of our investment strategy, alongside our Venture and Growth funds. Dedicated to growing the tech ecosystem from the ground up, it forms the foundation of our full-stack model.

Our experience over the past two years, doubling down on GP investments in Canada and beyond through Discovery Fund I, has reinforced our core thesis in the powerful upside of backing emerging managers.

Supporting the tech ecosystem, coast to coast and abroad

As we’ve executed this strategy, we’ve seen tremendous progress across the ecosystem and especially in Canada. In Inovia’s home province of Quebec, our fund investments include Luge Capital, Boon Fund, Front Row Ventures, FounderFuel and the recently closed Telegraph VC. In Ontario, funds such as Garage Capital, N49P Ventures, Northside, Union Capital, Two Small Fish Ventures and Roach have been active across the continent. British Columbia, originally a province where we saw limited emerging manager activity, has now sprouted some of our strongest funds, including GTMFund, Defined Capital and Metalab Ventures. In Alberta (where we’ve backed The51) and in many other provinces across the country, we are seeing further green shoots of activity, reinforcing our belief that every ecosystem should have nearby investors to support local activity.

We also continue to see strong growth of Canadian emerging managers abroad. We’ve backed a handful of Canadian expatriates who remain active in Canada, including WayFinder Ventures (recently acquired by General Catalyst), Roar Ventures, Mighty Capital and Blank Ventures. Our good friend Andre Charoo at Maple VC continues to be a strong supporter of Canadian entrepreneurs, regardless of their location, growing Maple’s reach across Asia while maintaining a strong presence in the Bay Area. Meanwhile, across the ocean, our emerging managers in Europe, Ada Ventures, Connect Ventures, and Kindred Capital continue their mission to support the European ecosystem with capital and expertise.

Discovery Fund I’s direct investments are equally wide-ranging, and include high-profile breakouts like poolside, co-founded by Jason Warner, former CTO of GitHub, as well as some less well-known upstarts transforming legacy industries like SecondShop and MaxSold. Across the portfolio, AI has been a significant theme supported by investments in companies like Reliant AI, BenchIQ, Jaide Health, Optionality and Tera AI, which’ve already received follow-on investment from the latest Inovia venture fund.

Charting the Evolution of Canada’s Next Generation VCs

Over the past two years, the trajectory of our emerging managers has been highly encouraging. We have seen them sharpen their strategies, scale their platforms, and establish reputations as leaders in their own right. Each firm has demonstrated how conviction, creativity, and focused strategy can translate into meaningful results for both founders and the broader ecosystem. Here are notable examples of this evolution:

- GTMfund’s graduation: Since our first interactions with GTMfund a year and a half ago, the firm has now announced the closing of its oversubscribed US$54 million Fund II. This significant milestone underscores GTMfund’s accelerating success and the clear value-add of its network. With a strong focus on B2B SaaS startups, GTMfund is building on its momentum to back the next wave of category-defining companies, including Vanta, Owner, Writer, Mutiny, and CaptivateIQ.

- The solo GP model has proven its strength:

- Defined Capital, led by a former BDC partner Mark Trevitt, has honed its thesis around early-stage AI frontier startups, carving out a distinctive position in a competitive market while backing star founders such as the teams behind Zyphra, Foundation, and Quandri.

- Northside Ventures and its GP Alex McIsaac also successfully closed its first fund at CAD $15 million, validating the potential of focused, founder-led investing. Alex McIsaac has also consistently identified top Canadian founders across geographies, including Datacurve, Veritree, and Boardy. Together, these firms exemplify how solo managers can combine agility with conviction to identify opportunities larger firms might overlook.

- Compelling collaboration opportunities: Our partnership with N49P and Spellbook illustrates how portfolio GPs and Inovia’s broader platform can coinvest to support high-potential startups across their lifecycle. Since N49P’s initial investment, Inovia has supported Spellbook at every stage, backing the company through its significant growth rounds.

“The Inovia team has gone above and beyond as an incredible institutional partner to us at the GTMfund. Their ability to act as a true sounding board, provide guidance, and facilitate introductions to their network has been a huge unlock for us as an emerging fund. We’re looking forward to many more years of working together.”

– Max Altschuler, Founding GP at GTMfund

“At N49P, we invested in Spellbook before most people saw how transformative it could be. We backed a great founding team with insight into where the world was going. Inovia’s continued partnership has helped the company scale that vision faster and more globally. This is exactly how Canada’s venture ecosystem should work: early-stage conviction paired with long-term support to help founders build enduring companies.”

– Alex Norman, Founding GP at N49P

A Look Back at Our Collective Achievements

By partnering closely with Canadian emerging managers, we have been able to achieve significant outcomes within the past 24 months:

- In Q2 of this year, eight of the ten top Canadian venture deals were Discovery-backed — clear proof of the pivotal role that our managers play in identifying and backing top Canadian companies, as reported by CBInsights. This concentration of influence highlights Discovery’s ability to consistently back companies that define the market’s leading edge.

- Our extended portfolio has also generated an impressive 37 unicorns to date, investing early in category-defining companies like Ada, Writer, Cohere, poolside, and Neo Financial. These outcomes reinforce the core premise of Discovery: That emerging managers possess a unique ability to recognize transformative founders earlier than the market at large.

- Innovation within artificial intelligence has also been a particular area of strength. Five Discovery investments earned recognition on the Forbes AI 50, while four others were named to CBInsights’ Most Promising AI 100.

The Road Ahead: Continuing to Fuel the Future

As we look forward, there is still much work to do. Recent data, such as that reported by Bloomberg, suggests that many new venture capital firms continue to face a challenging fundraising climate. Given the concerning trends in pre-seed & seed activity, which are declining from pre-pandemic levels (CVCA Current State of Seed Investing report), we know that the opportunity in Canada deserves greater capital investment.

Inovia remains unwavering in its commitment. We are actively and thoughtfully exploring how to continue enabling emerging managers and the earliest stages of the ecosystem, as we believe that reinforcing this segment of the market is imperative. Emerging managers fuel the vital pipeline for our country’s future innovation, identifying and nurturing the companies that will drive economic growth and global competitiveness for decades to come.

We are excited to continue building on this success.